Property finance loan calculatorDown payment calculatorHow A great deal home am i able to afford calculatorClosing costs calculatorCost of living calculatorMortgage amortization calculatorRefinance calculatorRent vs acquire calculator

Larger possible for fraud. Fraudsters have used self-directed IRAs as a means to add a stamp of legitimacy to their strategies. One particular widespread ruse is to say the IRA custodian has vetted or authorized of your fundamental investment, when, given that the SEC notes, custodians generally don’t Assess “the standard or legitimacy of any investment in the self-directed IRA or its promoters.”

These best robo advisors cost small expenses but still provide higher-high-quality options, including automatic portfolio rebalancing, exposure to A selection of asset lessons and monetary scheduling tools. Some also give access to fiscal advisors.

Since day buying and selling may be complex and dangerous, the Securities and Exchange Commission has issued a warning concerning this practice. You should buy and market exactly the same shares as typically as you desire, as long as you trade throughout the constraints imposed by FINRA on intraday pattern trading and that the broker lets it. Buyers who productively use The 2-hour-a-day approach usually Have a very good comprehension of how sector investing quantity will work (volume is really a evaluate of the volume of shares traded over a period of time and may reveal the temper and energy of the industry).

How to start out Investing With an SDIRA People who desire to take advantage of alternative investment options, and who may have thoroughly examined the threats, ought to research which custodial account providers do the job ideal for them. Think about getting these steps:

Self-directed IRA real estate: Become a property mogul within your IRA! Spend money on rental Attributes, land, or perhaps flip residences for passive profits and opportunity appreciation.

Investigate more daily life insurance resourcesCompare existence insurance policies quotesBest lifestyle insurance companiesChoosing a life insurance policies policyLife coverage reviewsLife insurance policies calculator

Although CNBC Select earns a commission from affiliate partners on a lot of presents and back links, we produce all our material without having input from our business team or any outside 3rd parties, and we pleasure ourselves on our journalistic specifications and ethics.

Obtain your totally free credit score scoreYour credit score reportUnderstanding your credit score scoreUsing your creditImproving your creditProtecting your credit

. In particular, Russia's navy presence along its border with Ukraine continues to be accumulating, and that's a central level where by it could immediately develop into a thing disastrous, he mentioned.

A self-directed individual retirement account (SDIRA) is often a sort of retirement account that lets you invest in a wider variety of assets as compared to a traditional IRA, where by the account custodian generally limitations you to definitely authorised asset styles.

Discover additional homeownership resourcesManaging a mortgageRefinancing and equityHome improvementHome valueHome coverage

Practically all brokers and mutual funds provide IRAs. You can prefer to open a self-directed IRA if you want quite check my source possibly the most overall flexibility when deciding upon your investments.

A self-directed IRA is often a tax-advantaged account that provides you more freedom compared to an IRA managed by go to this website a broker and also comes with a A great deal higher probability of ruining your retirement personal savings.

Haley Joel Osment Then & Now!

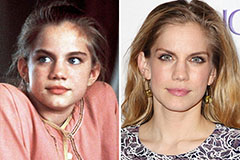

Haley Joel Osment Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Michael J. Fox Then & Now!

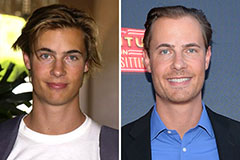

Michael J. Fox Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now!